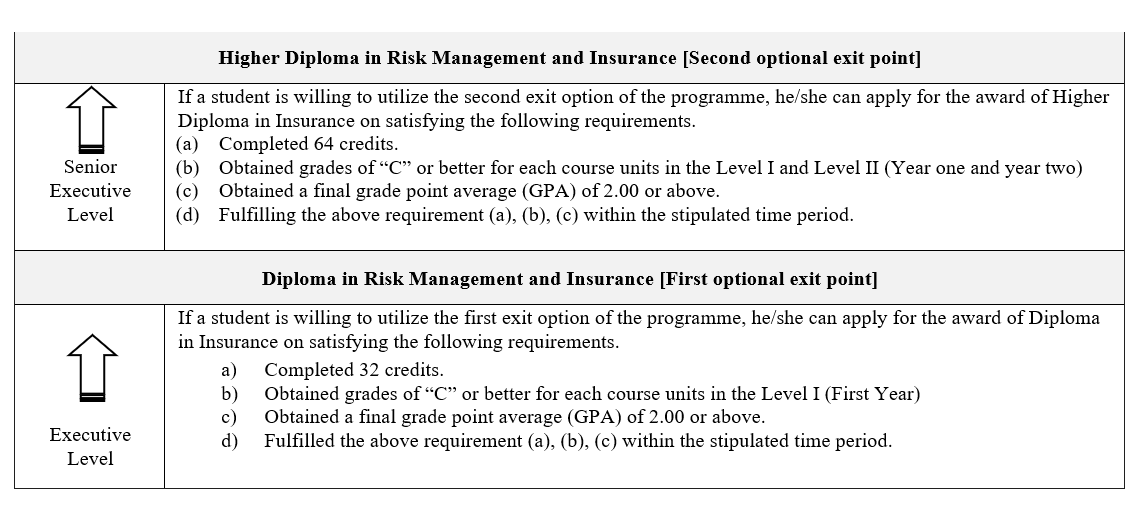

Diploma in Risk Management and Insurance

Professor. SK Gamage

Dean

Faculty of Business Studies & Finance

Dr. WS Sanjeewa

Director

Diploma in Risk Management and Insurance

Ms. DMNB Dissanayake

Academic Coordinator

Diploma in Risk Management and Insurance

Ms. JPSD Amarasinghe

Course Secretary

Diploma in Risk Management and Insurance

Ms. JAAK Jayalath

Administrative Coordinator

Diploma in Risk Management and Insurance

Higher Diploma in Risk Management and Insurance

Professor. SK Gamage

Dean

Faculty of Business Studies & Finance

Dr. WS Sanjeewa

Director

Higher Diploma in Risk Management and Insurance

Mr. DGL Rasika

Academic Coordinator

Higher Diploma in Risk Management and Insurance

Mr. MMSKB Bogamuwa

Course Secretory

Higher Diploma in Risk Management and Insurance

Ms. JAAK Jayalath

Administrative Coordinator

Higher Diploma in Risk Management and Insurance